There is something rotting in America. You can sense the decay in our presidential campaign process.

It stinks, it’s growing, and it’s dangerous.

There is something wrong when candidates for president attack each other for being rich and not paying enough in taxes. There is something wrong when Warren Buffett whines about paying a lower percentage tax rate than his secretary. Given the “tax the rich” fervor growing in America and around the world, I offer a different point of view on taxes.

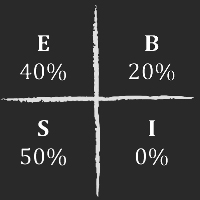

When I was a young boy, about 10 years old, my rich dad, my best friend’s father, drew this diagram:

He called it the CASHFLOW Quadrant, and said to his son and me, “The world of business is made up of four different categories of people.”

The Following Are His Explanations Of The Four Quadrants.

E Stands for Employees

These are the employees of a business — from the janitor to the CEO. As you know, many CEOs, men like Jack Welch, former CEO of GE, did not start the business for which they work. They are employees of the business. In this example, General Electric was founded by Thomas Edison. Those in the E quadrant always say the same words: “I’m looking for a safe, secure job, a steady paycheck and benefits.” Most Es are not entrepreneurs.

S Stands for Small Business or Self-Employed

These are small business owners and specialists. Many highly educated professionals such as doctors and lawyers fall into this category. Those in this quadrant often say, “If you want it done right, do it yourself.” Or, “It’s hard to find good help these days.” Or “I’m the best.”

B Stands for Big Business

These are companies with 500 or more employees. Entrepreneurs in this category are always saying, “I’m looking for great people to run my business.”

I Stands for Investor

These people are always looking for OPM, other people’s money, to fund their business projects. This category does not include people with 401(k) and IRA plans … who are the OP.

Who Pays the Most in Taxes?

The reason the quadrant is important is because it defines who pays the most in taxes. Someone says, “I’m a millionaire.” But the question is, “In which quadrant?” The diagram below shows the approximate tax rates for the different quadrants.

Each of us can look at this diagram and come to our own conclusions. If you are on the left side, the E and S side, you might say, “This is not fair. We should tax the rich.” And the tax laws do tax the rich in the E and S quadrants. The more you make as an E or an S, the more the government takes.

You might ask this question: “How do I move over to the B and I quadrants?” Or, if you are already in the B and I quadrants, you might say, “I’m fine. I’m happy with the tax laws.”

When I was a young boy, I knew which side of the quadrant I wanted to be on. That is why I did not follow my poor dad’s advice, advice that encouraged me to “Get a high-paying job, get out of debt, save money, and invest in a 401(k).”

Instead, I followed my rich dad’s advice and started businesses and created thousands of jobs. I use debt financing (or OPM), own thousands of apartment units, and participate in oil exploration projects. I don’t have a job or a 401(k). I do have great tax accountants and attorneys. Today, I am very happy with the tax laws.

Who is the Best President?

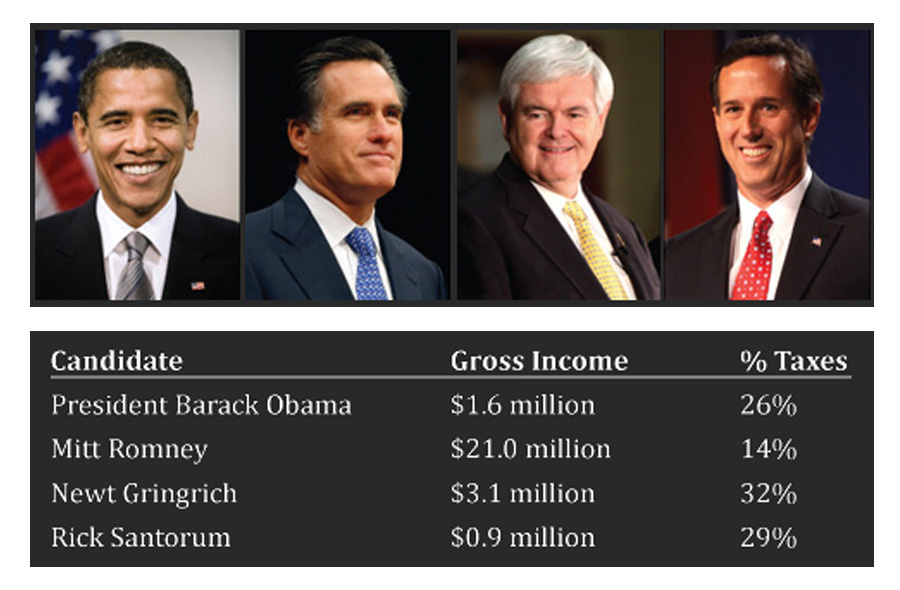

In looking at the field of contenders for president of the United States, it’s not hard to see which quadrant they see the world from and, consequently, their perspective.

I don’t know which man would be the best president, but I do know which candidate has the highest financial IQ. I can also guess which ones want to tax the rich, even if they are Republicans.

One person who might make a good president is Warren Buffett. He earns billions of dollars and pays less than 10 percent in taxes. Small wonder he feels guilty about his secretary paying a higher percentage in taxes.

Taxes Are Fair

I realize taxes may seem unfair. Yet, if you step back and ask, “Why do some millionaires pay less taxes than others?” you will find an interesting answer.

The answer is, “Taxes are revenue neutral.” This means the taxman takes and the taxman gives. If you do what the government wants done, you get tax breaks.

Many people see taxes as punitive … and, for most people, taxes do take money out of their pockets. Yet there is another side of taxes, the side very few people see. Taxes are actually incentives, a government stimulus plan to prod entrepreneurs to perform tasks the government wants done. Some of the things the government wants done are:

Jobs:

If you provide lots of jobs, you get tax breaks. If you are an employee, you pay the tax. This is “revenue neutral.”

Housing:

If you provide housing, such as apartment houses, you receive many tax breaks. People who own their own home, but do not provide rental property, pay the tax.

Debt:

The government wants people to borrow. That’s why interest rates are so low. There are tax breaks for debt, but there is a tax on savings. The government does not need savers. It needs debtors to move money into the economy.

Energy:

Civilization runs on energy. This is why there are tax breaks for oil, wind, and solar companies. The taxes are collected each time you fill up your gas tank.

Food:

If the economy had no food, we might all be cannibals. This is why there are farm subsidies. Again, the taxes are collected from the consumers.

I Am Not an Accountant

Do not take my word as gospel. I am an entrepreneur — not an accountant. But I do have great tax advice. My tax advisor, Tom Wheelwright, CPA, is the person who supplied the information for this article, and the author of Tax-Free Wealth, a Rich Dad Advisor book. His views on taxes, detailed in the book, are enlightening. Even if you do not read the book yourself, give it to your tax advisor and discuss it. You may find new ways of helping our government and save money on taxes in the process.

As the “tax the rich” fervor grows, it is important for all of us to get smarter … especially about taxes.